Before starting this article, I want to make sure that you understand that I’m neither a lawyer nor an accountant. This advice is just based on my opinion. I definitely recommend talking to both a lawyer and an accountant before getting started.

One of the most important decisions you have to make when starting a company is choosing a business structure. The legal structure influences your taxes, the protection of your personal assets, the amount of paperwork, and the potential to raise money.

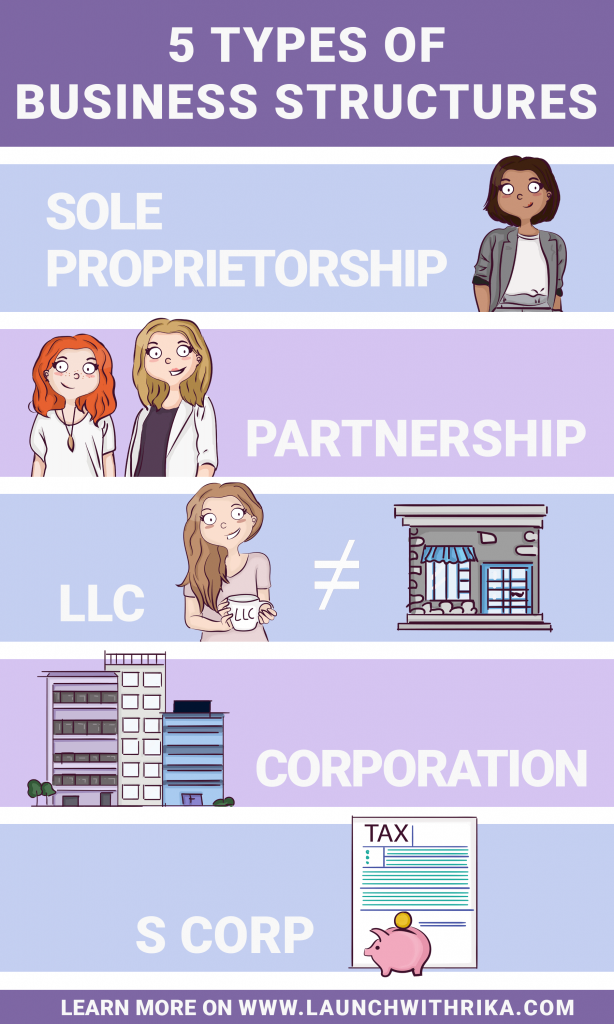

The five most common business structures are Sole Proprietorship, partnership, LLC (limited liability company), corporation and S corporation. Carefully consider the advantages and disadvantages of each business structure to find the right one for you.

Changing to a different business structure in the future is sometimes possible. The difficulty and amount of paperwork depend on from which to which business structure you want to switch.

You’ll need to choose a structure to register your business. Additionally, you’ll most likely need an EIN (employer identification number) to file your taxes and to open a bank account. I definitely recommend talking to a lawyer and an accountant. You can also get help from business organizations like SCORE, your local chamber of commerce and the small business administration.

- 5 Types of Business Structures Infographic

- Sole Proprietorship

- Partnership

- Limited Liability Company

- Corporation

- S Corp

5 Types of Business Structures

Sole Proprietorship 🙋♀️

A Sole Proprietorship might be right for you if you run the business by yourself. The IRS will automatically see you as a sole proprietor if you don’t register with a different business structure. Setting up a Sole Proprietorship is pretty easy and inexpensive. You’ll have full control over the business. Filling your taxes as a sole proprietor is also fairly straightforward. The taxes can be filled through your personal income return. However, your personal assets are not protected. You’ll be responsible for the losses, debt, and liabilities.

A Sole Proprietorship doesn’t have any stocks to sell so raising money can be difficult. Some banks also might be hesitant to offer loans to Sole Proprietorships. This business form could be the right choice to get started and to test your idea before transitioning to a different business structure.

Partnership 👯♀️

A partnership can be a good option if you’re building a company with 2 or more people. Make sure you only start a company with someone you trust.

Partnerships can be divided into General and Limited Partnerships. In a General Partnership, the partners work as co-owners. You can share the work and benefits. However, you both will be on the hook for liabilities even if your partner screwed up. You and your partner are basically the company. This means your private assets won’t be protected in cases of debt, losses, and liabilities. Setting up a General Partnership requires little paperwork. It’s a bit more expensive than setting up a Sole Proprietorship.

In a Limited Partnership, you can have general as well as limited partners. To establish a Limited Partnership you need at least one general and one limited partner. The general partner has all control and responsibility. As a limited partner, you have ownership in the company. However, you don’t have to take on the risks and liabilities. Establishing a Limited Partnership requires more paperwork and admin work.

LLC (Limited Liability Company) 🏢 ≠🙋♀️

An LLC is a mix of a partnership and a corporation. Setting up an LLC is not too complicated and also not very expensive. When you decide to form an LLC, you need to follow LLC guidelines. This includes keeping your private and business expenses separate. Make sure to invest in good bookkeeping. If you follow these guidelines and your business gets into trouble, your private assets are usually more protected. Business taxes can be filed through your personal taxes and you can avoid the corporate taxes. You do have to pay self-employment tax though. Setting up an LLC with multiple members requires additional forms when you file your taxes.

Corporation 🏢

In a corporation, also called C Corp, the business is treated as a separate entity. Here, the business is basically its own person. This business structure protects your personal assets the most. It’ll also be easier to raise money because you can sell stocks. That’s why a corporation is recommended if you want to bring on investors or if you eventually want to go public. It’s the most expensive structure and also the one with the most complicated setup.

Managing the required documents, fees and taxes can be very time consuming and confusing. You also need to consider that corporations are double-taxed. Your business is taxed and then every shareholder has to pay tax on their personal income.

S Corporation 💵

With an S corporation (S Corp), business owners can avoid double taxation while their personal assets are still protected. The way an S corp is taxed depends on the state. An S Corp can’t have more than 100 shareholders and all shareholders must be U.S. citizens. You can also only offer one type of stock, which may make raising money more difficult. An S Corp has to follow similar requirements like a C Corp. So keeping up with rules is still a lot of work. The fees associated with creating and maintaining an S Corp are also comparable to a C Corp.

Deciding on a business structure has impacts on your liability, ownership, required fees, paperwork, and taxes. Remember that the requirements for each legal structure can be different for each state and that laws can change

Choosing a business structure is just one part of starting your business. Learn more about what you need to do to set up a company.